Not known Details About Clark Finance Group Home Loan Lender

Table of ContentsThe Greatest Guide To Home Loan CalculatorHow Clark Finance Group Mortgage Broker can Save You Time, Stress, and Money.Refinance Home Loan Things To Know Before You Get ThisThe Buzz on Clark Finance Group

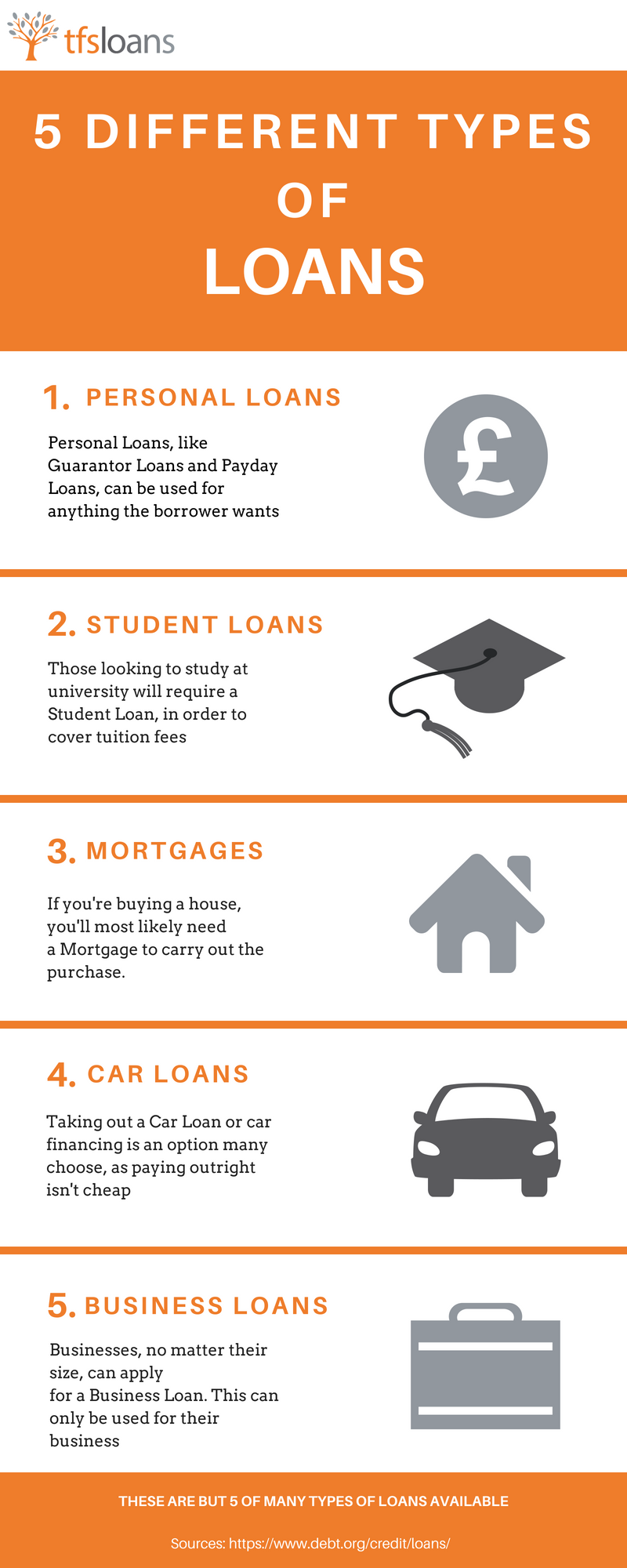

All loans aren't produced equivalent. If you require to borrow money, first, you'll desire to choose which type of financing is ideal for your scenario.

If you have high-interest charge card financial debt, an individual finance may help you settle that financial debt faster. To settle your financial debt with a personal loan, you 'd look for a lending in the amount you owe on your bank card. If you're accepted for the full amount, you would certainly make use of the loan funds to pay your credit report cards off, rather making monthly repayments on your individual lending.

That's since the loan provider might take into consideration a protected finance to be much less risky there's a possession supporting your funding. If you don't mind vowing security and you're confident you can repay your loan, a secured funding may aid you save money on interest. When you use your security to take out a finance, you risk of shedding the home you used as security.

The Main Principles Of Clark Finance Group Home Loan Lender

You'll take a thing of worth, like an item of jewelry or an electronic, right into a pawn shop and obtain money based on the thing's worth. Finance terms differ based on the pawn store, and also interest prices can be high.

You might likewise obtain hit with charges and additional expenses for storage space, insurance policy or renewing your loan term. Payday different loan amounts vary from $200 to $1,000, as well as they have longer payment terms than payday finances one to 6 months rather of the typical couple of weeks you obtain with a cash advance car loan.

A residence equity lending is a kind of secured financing where your home is utilized as collateral to obtain a round figure of cash. The quantity you can obtain is based on the equity you have in your house, or the distinction between your residence's market price and also exactly how much you owe on your home.

Given that you're using your home as security, your passion price with a home equity lending may be reduced than with better mortgage rates an unsecured personal lending. You can use your residence equity financing for a range of objectives, varying from home renovations to medical bills. Prior to taking out a house equity financing, see to it the settlements are in your budget plan.

Getting The Mortgage Broker To Work

She delights in aiding individuals find news methods to much better manage their cash. Her job can be found on countless sites, including Bankrate, Money, Bu Find out more. Review More.

Below are the most usual kinds of loans and also just how they work. Secret Takeaways Personal finances and also credit cards come with high passion prices however do not require security.

Cash money advancements generally have very high passion prices plus purchase costs., which implies that the consumer does not put up collateral that can be confiscated in case of default, as with an automobile funding or house mortgage.

How Refinance Home Loan can Save You Time, Stress, and Money.

Interest rates can be even more than three times that amount: Avant's APRs vary from 9. 95% to 35. 99%.

Financial institution Loan vs. Bank Assurance A small business loan is not the like a financial institution guarantee. A financial institution may release a guarantee as guaranty to a 3rd celebration in behalf of one of its clients. If the client stops working to meet the relevant contractual obligation with the 3rd party, that event can demand payment from the financial institution.

A company might accept a specialist's bid, as an example, on the condition that the professional's financial institution issues a guarantee of payment in the occasion that the professional defaults on the agreement. An individual lending might be best for a person that requires to borrow a fairly tiny quantity of cash as well as is certain of their ability to settle it within a pair of years.